Swapping tokens is one of the core activities in decentralized finance (DeFi), but it often comes with hidden costs that can reduce your profits. Many traders face slippage and unnoticed fees without fully understanding how they happen or how to prevent them. This guide will walk you through what slippage and hidden fees are, how they affect your trades, and practical ways to minimize them while managing gas costs effectively.

Key Takeaways

- Slippage happens when the price of a token changes between initiating and finalizing a swap, often leaving you with fewer tokens than expected.

- You can adjust slippage tolerance on most exchanges to control how much price fluctuation you’re willing to accept.

- Ethereum gas fees vary with network congestion—choosing off-peak times or switching to Layer 2 networks can reduce costs.

- Reviewing hidden platform or transaction fees before confirming a trade helps avoid surprise expenses.

Understanding Slippage in Token Swaps

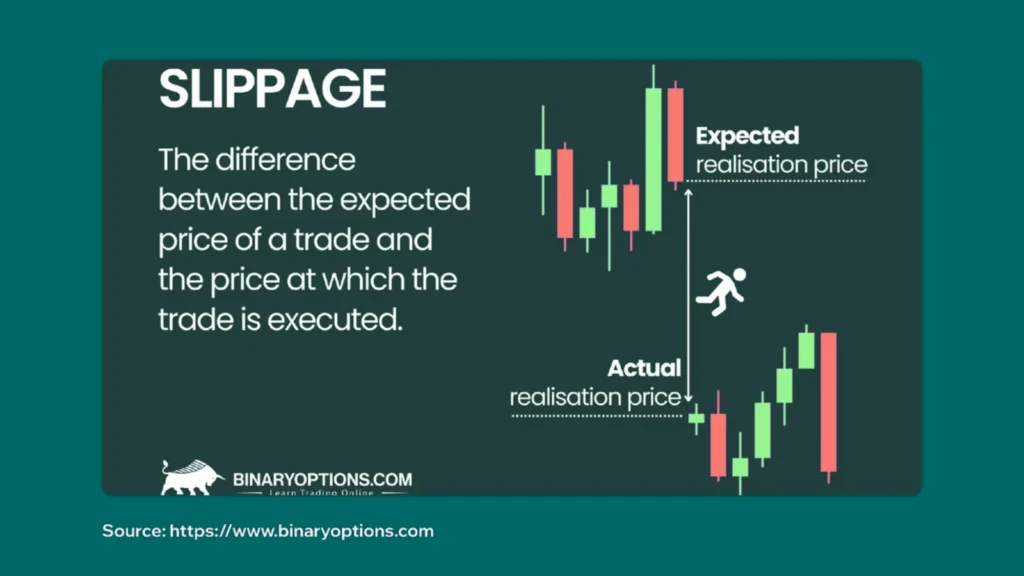

Slippage is the difference between the expected price of a token and the executed price after your trade confirms. Unlike centralized exchanges that use order books, decentralized exchanges (DEXs) rely on liquidity pools. When you initiate a swap, the pool price can shift in the short time it takes for your transaction to confirm.

This effect is stronger during high market volatility or when trading in low-liquidity pools. Large trades in smaller pools can even move the market against you, reducing the number of tokens you receive.

For example: if you plan to buy tokens worth $100 but the final executed price is $102, the slippage is 2%. While slippage can occasionally benefit you, it more often leads to less favorable trades—especially in fast-moving or illiquid markets.

The Importance of Liquidity

Liquidity plays a huge role in slippage.

- High-liquidity pools can absorb large trades with minimal price changes.

- Low-liquidity pools, on the other hand, react sharply even to moderate trades, causing significant slippage.

Before swapping, always check the liquidity of the pool. Many DEX platforms display this data, allowing you to decide whether the trade is worth executing or if you should wait for a better pool.

Setting Slippage Tolerance

Most DEXs allow you to set slippage tolerance, which defines how much price movement you’re willing to accept before the trade is canceled.

- Too low tolerance → frequent failed transactions in volatile markets (still costing you gas fees).

- Too high tolerance → vulnerability to front-running bots and large unfavorable price swings.

For stablecoins or highly liquid pairs, a low tolerance (e.g., 0.1%–0.5%) is usually safe. For more volatile tokens, you may need to set it slightly higher. Striking the right balance is key to successful trades.

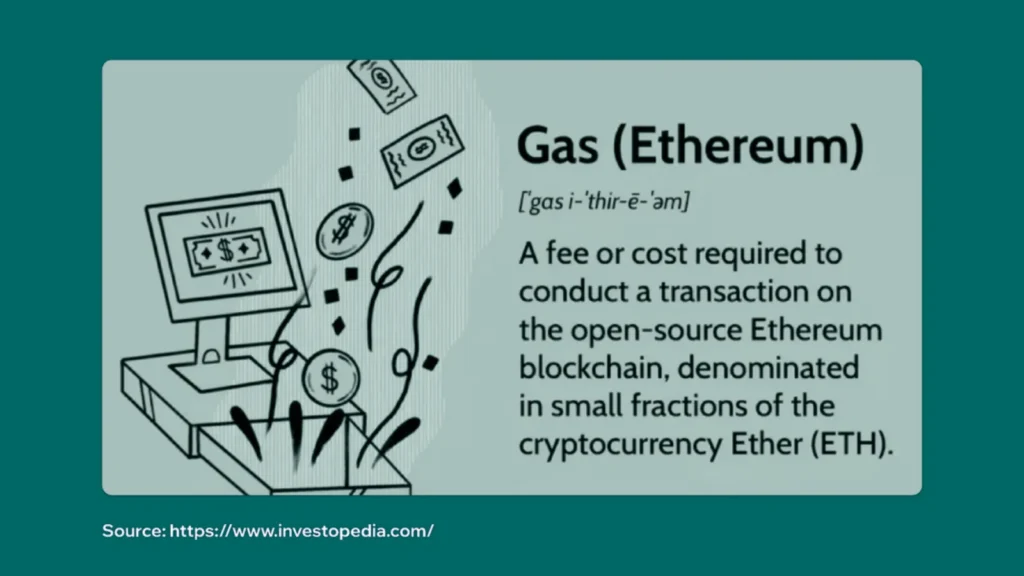

Gas Fees on Ethereum

Gas fees are another factor that impacts token swaps on Ethereum. Every action—whether swapping tokens or approving transactions—requires gas, paid in ETH.

Gas prices depend on two factors:

- Base fee – Adjusts automatically with network congestion.

- Priority fee (tip) – Incentivizes miners/validators to process your transaction faster.

During peak activity, these fees can rise sharply, making even small swaps costly. Being mindful of gas costs is crucial to protect your profits.

Managing and Reducing Gas Costs

To keep gas fees under control:

- Trade during off-peak hours – Late nights or weekends usually have lower activity.

- Use gas trackers – Tools can help identify the cheapest transaction windows.

- Adopt Layer 2 solutions – Networks like Arbitrum or Base process transactions off-chain and settle them on Ethereum, drastically lowering fees while keeping Ethereum’s security.

- Consider gas tokens – Mint them when fees are low, redeem when fees are high, to offset transaction costs.

Hidden Fees: Where They Lurk

Hidden fees often go unnoticed but can eat into profits. These may include:

- DEX platform fees on top of network charges.

- Minimum swap charges, which hit harder on small trades.

- Different blockchain costs – Swapping ERC-20 tokens on Ethereum is pricier than using BNB Chain or Solana.

Always review the transaction breakdown before confirming. Using aggregator platforms can also help—these compare multiple DEXs to show the true cost of your swap, letting you choose the cheapest option.

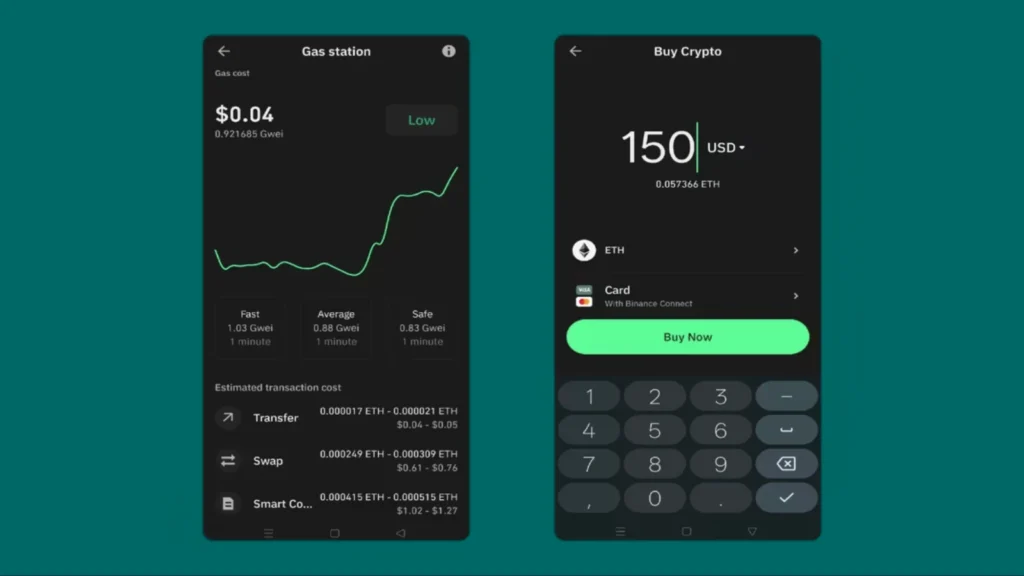

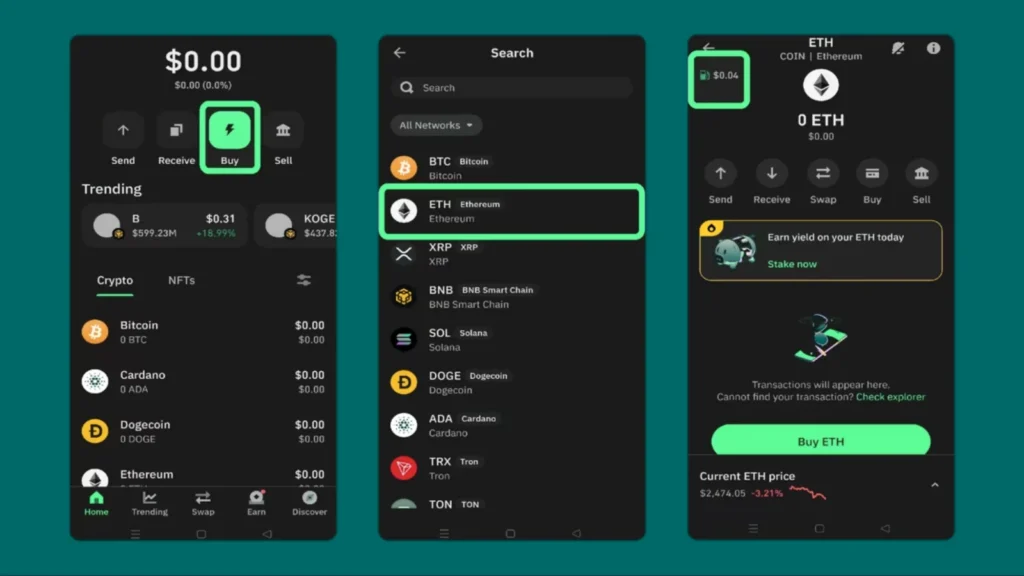

How to Buy Ethereum Using Trust Wallet

Buying Ethereum with Trust Wallet is quick and secure:

- Search for “Ethereum” or “ETH” and select it.

- Tap the fee icon to check current gas fees.

- Click “Buy”.

- Choose your currency and enter the amount of ETH you want.

- Select your provider and payment method.

- Tap “Buy” and complete the purchase steps.

Making Smart Swaps

The smartest way to avoid slippage and hidden costs is preparation:

- Check liquidity levels before executing a swap.

- Set a reasonable slippage tolerance.

- Keep an eye on Ethereum gas fees and use Layer 2s or off-peak timings.

- Always review all charges—both platform and network fees—before confirming.

By following these steps, you’ll make your swaps more efficient, avoid costly surprises, and maximize your returns in DeFi.