Crypto in 2025 is bigger and noisier than ever. The market runs 24/7, news breaks every second, and thousands of projects compete for attention.

For beginners, the main problem is: Where do I start?

For professionals, the problem is: How do I filter all this information without missing something important?

The truth is, information is the most valuable thing in crypto. Whether you are checking token prices, studying a new project, or looking for secret trading opportunities, your information sources matter the most. The wrong news, wrong numbers, or wrong rumor can cost you money, time, and trust.

This article will explain the trusted Fintechzoom.com Crypto news and data sources in 2025. Instead of just giving you a list, we’ll group them into categories, explain their best uses, and match them to the right type of user.

Think of this as a survival guide—a way to build your own set of tools depending on whether you are new, experienced, or a pro.

Fintechzoom.com Crypto News Source Types

Tracking Prices & Market Basics

CoinMarketCap (Beginner)

CoinMarketCap, also known as CMC, is still the first stop for most people. It has been around for more than 10 years and shows clear market data: token prices, trading volumes, charts, and exchange rankings. For beginners, it is easy—just type a token name, see where it trades, and check liquidity.

The strength of CMC is its standard format. Every project has a page, every exchange is ranked, and everything is connected. This structure helps when you are learning. The data is not always perfect because fake trading still exists, but for beginners, CMC works like a compass.

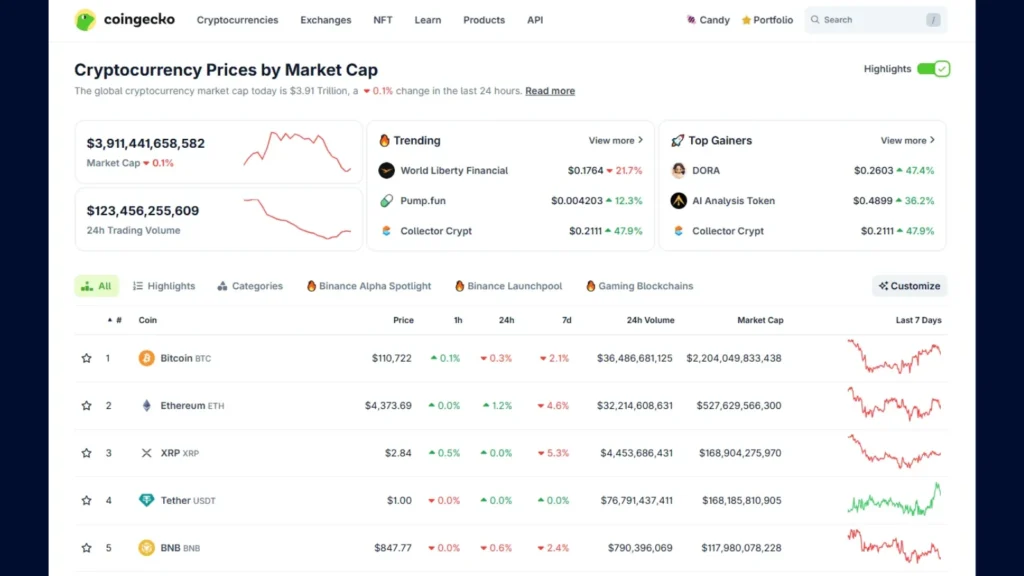

CoinGecko (Beginner to Intermediate)

CoinGecko is similar but plays a different role. It is seen as more independent and covers smaller exchanges, DeFi, and NFTs. By 2025, CoinGecko has become a complete dashboard for the whole crypto ecosystem.

It is more community-driven. Features like ratings, APIs, and GeckoTerminal (real-time DEX data) allow users to explore deeper without paying much. If CMC is like a neat museum, CoinGecko is like a busy market—messy but full of life.

For beginners, both are great. For intermediate users, CoinGecko often becomes the main tool because of its independence and variety.

Looking at Projects as Businesses

KEYRING Blog (Beginner to Intermediate)

KEYRING Blog is more than just news. It saves time by giving clear project summaries, market insights, and researched airdrop opportunities.

For beginners, it offers simple explanations of projects. For more experienced readers, it provides deeper analysis that connects market moves and project fundamentals.

Think of it as a library and guide that cuts noise and helps you see the bigger picture.

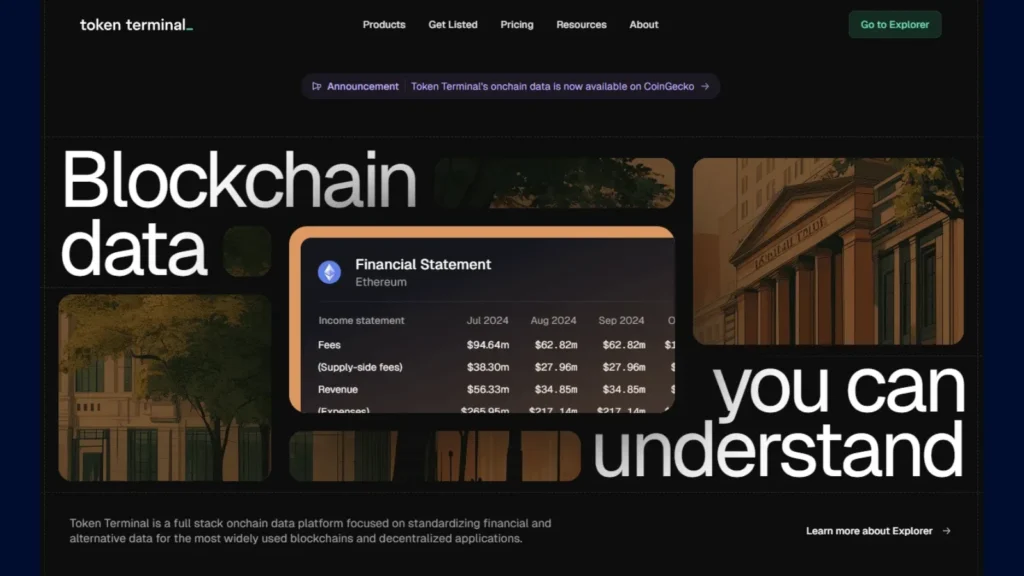

Token Terminal (Intermediate)

At some point, just looking at price charts is not enough. Serious investors need to ask: Does this project make money? Is it sustainable? Token Terminal is built for this.

It works like Bloomberg for crypto. It shows revenue, fees, P/E and P/S ratios, and compares projects. In 2025, treating protocols like real businesses is necessary.

For example, you can compare Uniswap’s revenue with Aave’s fees directly. This gives insights that price alone cannot. Token Terminal is for fund analysts, serious investors, and those moving from speculation to fundamentals.

On-Chain Analytics for the Data-Driven

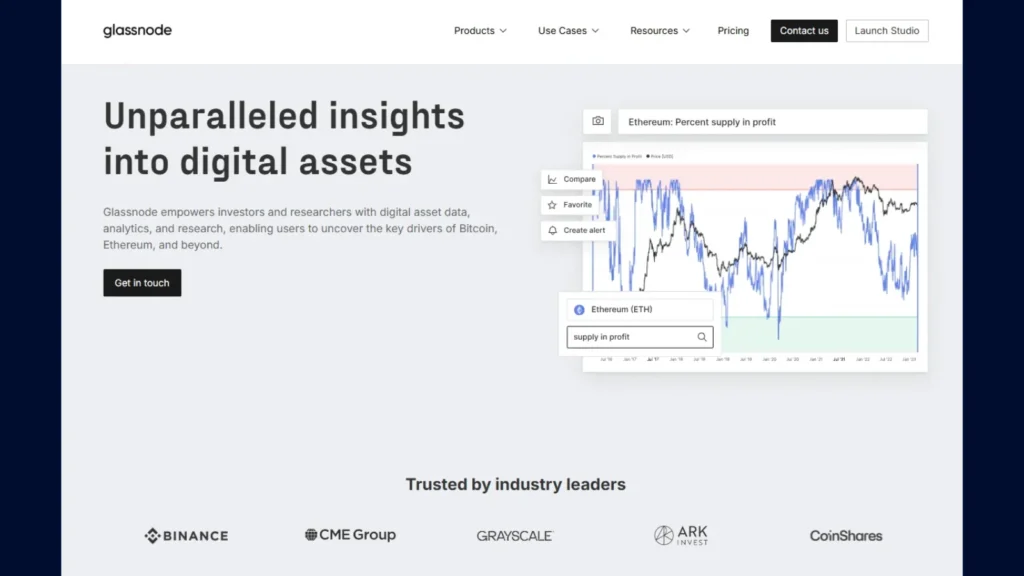

Glassnode (Advanced)

Glassnode is the gold standard for on-chain data. It shows metrics like exchange inflows, miner balances, realized price, and more. It filters noise and adds context.

For traders, it provides an edge beyond charts. You can see if short-term holders are selling while long-term holders are buying. You can measure market behavior, not just prices.

CryptoQuant (Advanced)

CryptoQuant is similar but focuses on alerts and real-time dashboards. Users can set custom alerts, like big exchange inflows, and act quickly.

It is easier for semi-advanced users because of its guides and visuals. Traders use it to turn data into signals. Together, Glassnode and CryptoQuant are the pro’s deep analytics toolkit.

News & Events: Staying Current

Decrypt (Beginner)

Decrypt is great for beginners. The headlines are short, the writing is simple, and it often explains tokens clearly. It mixes news, guides, and cultural updates, making it easy to follow.

Cointelegraph (Beginner)

Cointelegraph is one of the oldest crypto media sites. It is fast, colorful, and covers everything—from Bitcoin regulation to NFT launches. Many people check it daily.

Both Decrypt and Cointelegraph are easy for beginners because they keep things simple.

CoinDesk (Intermediate)

CoinDesk is more professional. It writes for policymakers, institutions, and experts. It covers macroeconomics, regulation, and adoption.

In 2025, it is still the go-to for serious news. If the SEC makes an announcement, CoinDesk reports it first.

The Block (Intermediate)

The Block is even more research-focused. It offers in-depth reports on market structure, funding, and trends. Many institutions pay for its premium research.

If Decrypt is for casual readers, and CoinDesk is for professionals, The Block is for those who want detailed industry reports.

Twitter/X (Advanced)

Twitter (now X) is the fastest but also the riskiest place for crypto info. Developers, traders, and researchers share updates, but rumors spread fast too.

The best news appears here first—but so does the worst misinformation. For advanced users, X is essential. For beginners, it’s dangerous without strong filters.

DeFi Flows & Capital Tracking

CoinGecko (Beginner)

CoinGecko is also useful for beginners to check DeFi and NFT trends quickly.

DeFiLlama (Intermediate)

DeFiLlama is the best free tool for tracking total value locked (TVL), fees, chain activity, and liquidity shifts. It is transparent and widely trusted.

It shows if money is moving from one chain to another, making it the heartbeat of DeFi.

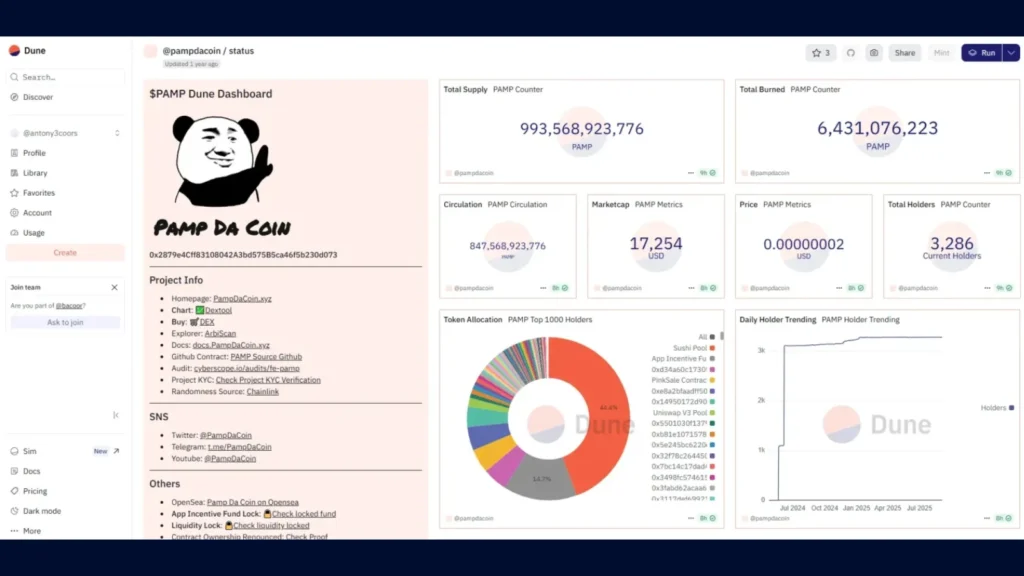

Dune Analytics (Advanced)

Dune lets users create custom dashboards using blockchain data. You can track anything—airdrops, votes, NFT sales, or liquidity flows.

It requires some skill but is powerful for researchers and serious traders.

Community & Insider Information

Twitter/X Project Page (Beginner)

The easiest step is to follow official project accounts. Most updates appear there first.

Telegram (Intermediate)

Telegram is the center of many crypto communities. Projects share announcements and discussions here. But it’s full of scams, so you must be careful.

Discord (Advanced)

Discord is where builders talk. Teams discuss development, governance, and technical issues here. It’s harder to access but gives insider-level information.

Who Should Use What?

- Newcomers → CoinGecko + Decrypt

- Intermediate users → Token Terminal + DeFiLlama + The Block

- Advanced users → Dune + Glassnode + X + Discord

A Daily Workflow Example

Here’s a simple routine for 2025:

- Morning (10 min): Check CoinGecko/CMC for price movers and Cointelegraph for headlines.

- Midday (15 min): Check Token Terminal for revenue trends and DeFiLlama for liquidity shifts.

- Afternoon (20 min): Review a Dune dashboard or a Glassnode metric.

- All day: Keep X open for trusted researchers and watch Discord for project updates.

This balance keeps you updated without wasting hours.

Conclusion: Building Your Own Information Stack

In 2025, crypto information sources are huge. No single source is perfect. Each serves a role: prices, fundamentals, news, flows, or community.

The key is not to follow everything but to build your own stack.

- Beginners can stick with CoinGecko and Decrypt.

- Analysts should use Token Terminal and The Block.

- Pros need Dune, Glassnode, and X.

Crypto is an information game. Prices move because of actions, and actions happen because of information. Choose the right sources, filter wisely, and you’ll stay ahead of the noise.